WE OFFERING

![]() In short, Polinvesta offers complex and multifaceted support throughout the funding process. Our offer is geared towards companies that are in dynamic growth, investors seeking out investments, as well as for those wanting to sell their shares in a business.

In short, Polinvesta offers complex and multifaceted support throughout the funding process. Our offer is geared towards companies that are in dynamic growth, investors seeking out investments, as well as for those wanting to sell their shares in a business.

When signing on with us, you will not only receive professional counsel with regards to the funding process. Our clients receive various documentation tailored to the specific situation that becomes their own private property.

⇓

FOR INVESTORS

![]() For our clients that wish to invest, we seek out projects in Poland that will become a stable source of income and aid in the investment process, from locating attractive projects to filling out paperwork and navigating through local laws.

For our clients that wish to invest, we seek out projects in Poland that will become a stable source of income and aid in the investment process, from locating attractive projects to filling out paperwork and navigating through local laws.

Why Poland?

Read below about the benefits of investing in Poland.

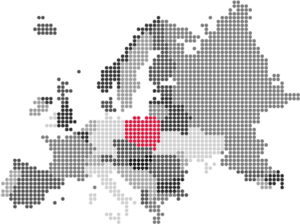

WHY POLAND?

Poland is ranked as the 6th largest economy in the European Union and the only to avoid a GDP decline during the Sovereign Debt Crisis. The country also has a robust economy: $1.11 trillion PPP as of 2017, has generally stable credit ratings, and strong growth.

Poland is ranked as the 6th largest economy in the European Union and the only to avoid a GDP decline during the Sovereign Debt Crisis. The country also has a robust economy: $1.11 trillion PPP as of 2017, has generally stable credit ratings, and strong growth.

Furthermore, Poland offers foreign investors incentives that have already substantially attracted investments from all over the world.

There are 14 Special Economic Zones which are administratively separate from the rest. These zones have well-equipped facilities, and include property and income tax exemptions.

Further information: Deloitte Reports, Polish Investment & Trade Agency, Santander Trade Portal, Stern NYU Data

GDP

In comparision:

UK: 1,3%, USA: 3.8%, India: 7.3%

ROC

In comparision:

UK: -198.96%, USA: -794.29%, India: 1928.44%

CR

In comparision:

UK: AA Negative, USA: AA+ Stable, India: BBB- Stable

FOR CAPITAL HUNGRY

![]() For our clients that wish to sell their shares in a business we provide business exit planning. The process of exiting a business is intimidating and often filled with mazes that one must navigate through, and this is exactly the support that we provide so you are not alone. From evaluating the timing of an exit, valuation of your shares, identifying potential buyers, to negotiations and preparing the final documentation, we are here to guide you.For our clients that wish to find an investor, we do not just stop at finding an investor. Our services range from preparing business plans, contract negotiations, and finalizing the investment.

For our clients that wish to sell their shares in a business we provide business exit planning. The process of exiting a business is intimidating and often filled with mazes that one must navigate through, and this is exactly the support that we provide so you are not alone. From evaluating the timing of an exit, valuation of your shares, identifying potential buyers, to negotiations and preparing the final documentation, we are here to guide you.For our clients that wish to find an investor, we do not just stop at finding an investor. Our services range from preparing business plans, contract negotiations, and finalizing the investment.

Our experience in the field allows us to locate various investors, such as:

FINANCIAL INVESTORS

Financial investors are those considered to be in private equity and venture capital. Financial investors typically invest large amounts of capital in a business that have solid business plans and already shown signs of success, and in return receive equity capital. In general, partial ownership is handed over in return for funding.

INDUSTRY INVESTORS

For industry investors, the most important goal is strengthening the long-term standing of multiple competing firms in the industry. These investors do not focus on a particular company’s/projects return on investment or risk, but instead are guided by effects of the whole group. These investors usually seek out control and full ownership of the project or business.

ANGELS INVESTORS

When referring to angel investors, we often refer to entrepreneurs who want to leverage their wealth by investing in projects that see potential in, especially in start-up projects. Angel investors usually provide funding in the form of a loan or stock purchase. In certain situations, an angel investor will mentor or advise the business. Seed funding is used at the beginning stages of a project/company. While most often companies are able to find funding from friends and family, sometimes external funds are needed. Investors that offer seed funds get an equity in the business.

WHY POLINVESTA?

We will find the best suited and interesting projects to invest in. When coming to us, you can count on professionalism in every aspect of running a business abroad.This means:

Seeking out investments

Thorough analysis of chosen projects

Evaluation of potential projects

Potential Profit Calculations

Translator present at contract signing

Lawyer Consultation

Lawyer Consultation

CONTACT US

Have questions or are looking for other solutions? Send us a message or contact us, we’re here to help.

CONTACT DETAILS

-

ADDRESS

C220d Trident Business Centre

89 Bickersteth Road

SW17 9SH London -

PHONE

PL: +48 604 500 568

-

EMAIL